stock market bubble definition

Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. During the growth period of a stock market bubble stock prices falsely inflate because their perceived.

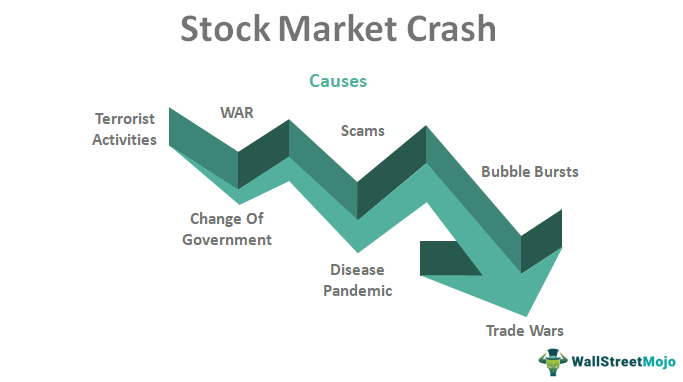

Stock Market Crash Definition Causes How To Prepare

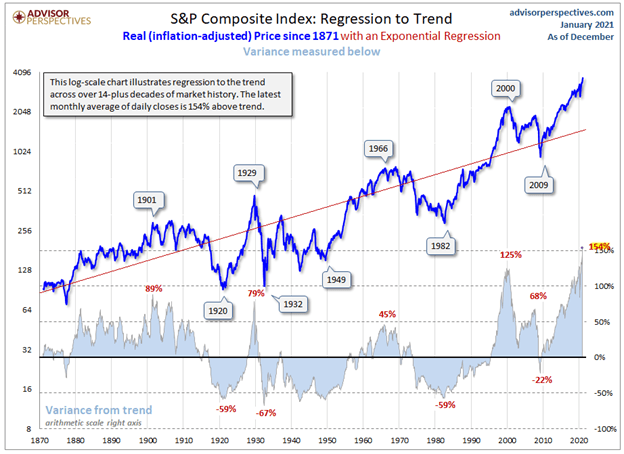

A bubble is an economic cycle that is characterized by the rapid escalation of market value particularly in the price of assets.

. Investors lose track of rational expectations. A bubble is defined as a period when prices rise rapidly outpacing the true worth or intrinsic value of an asset market sector or an entire industry such as real estate. What is STOCK MARKET BUBBLE.

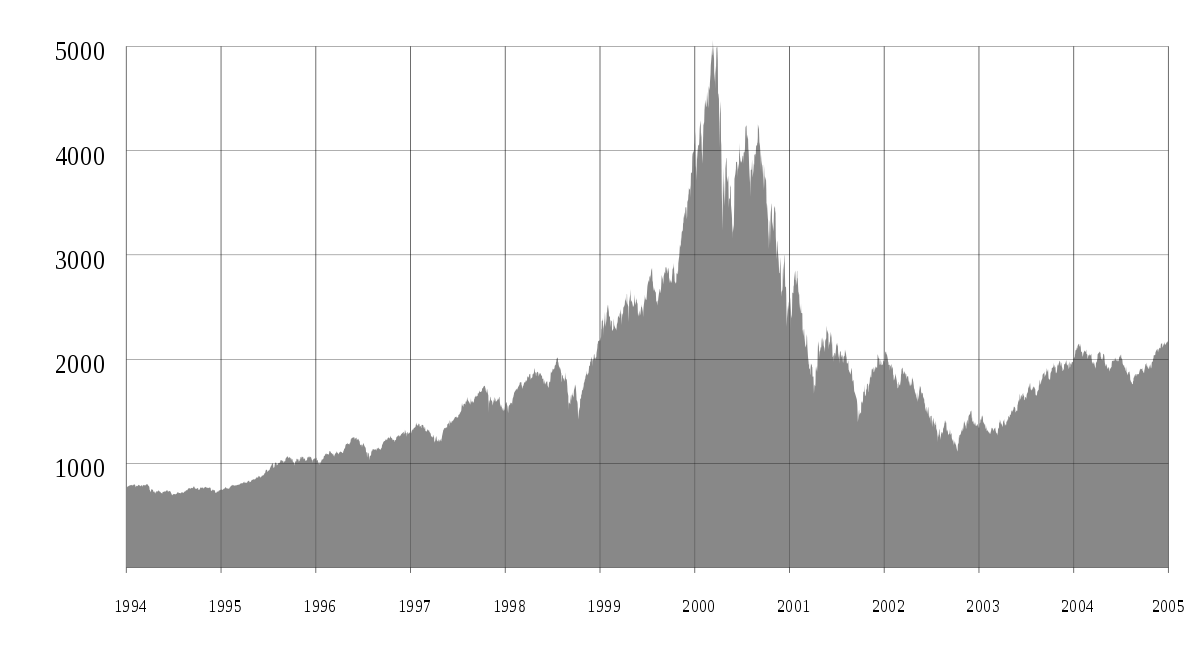

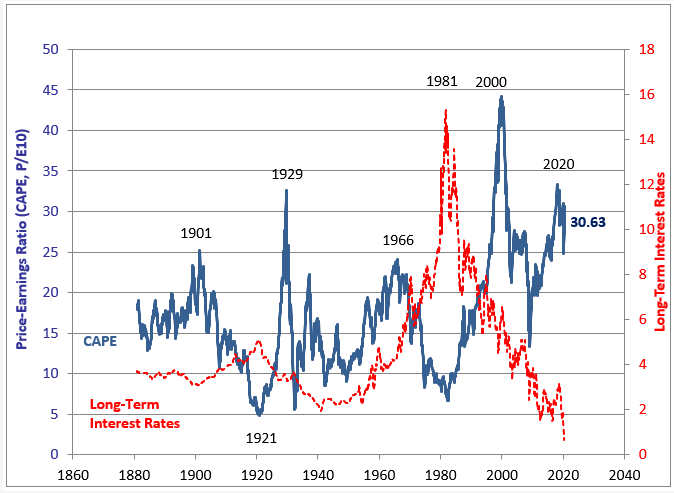

The dotcom bubble also known as the Internet bubble grew out of a combination of the presence of speculative or fad-based investing the abundance of venture capital funding for startups and. Despite market volatility following recovery from the global financial crisis historically low interest rates increased consumer spending and. Psychological biases lead to a massive upswing in the price of an asset or.

Tulipmania is a model for the general cycle of a financial bubble. What does STOCK MARKET BUBBLE mean. Stock market bubbles see share valuations soar to unjustifiable levels.

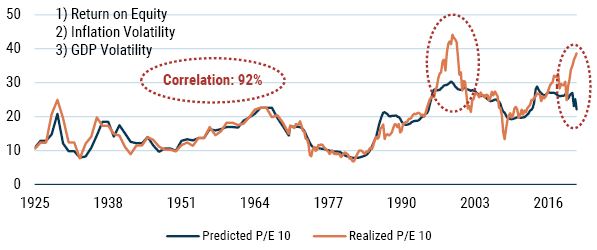

Stock market bubbles and bubbles more generally are an enduring feature of financial markets. The bottom line. A new product might have real value but enthusiasm tips into irrationality followed by reckless speculation and an upward price spiral.

This fast inflation is followed by a quick decrease in. New Stock Market Asset Bubble. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a period of time well in excess of its.

STOCK MARKET BUBBLE meaning - STOCK MARKET BUBBLE definition - STOCK MARKET BUBBLE explanati. There are well-known often specific reasons they occur. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

Learn how spotting the signs that a bubble is in play can protect your share portfolio. Bubbles that have formed in the United States once they burst seem to have had various degrees of economic consequences. Many times a stock market crash and economic slowdown follow a bubble burst.

Bubbles occur not only in real-world mark. The term bubble in an economic context generally refers to a situation where the price for somethingan individual stock a financial asset or even an entire sector market or. For instance the exceedingly strong bull market in stocks and formation of the Internet Bubble in the late 90s led to the decline in stocks and the decimation of the Internet Bubble in the 2001-2003 period.

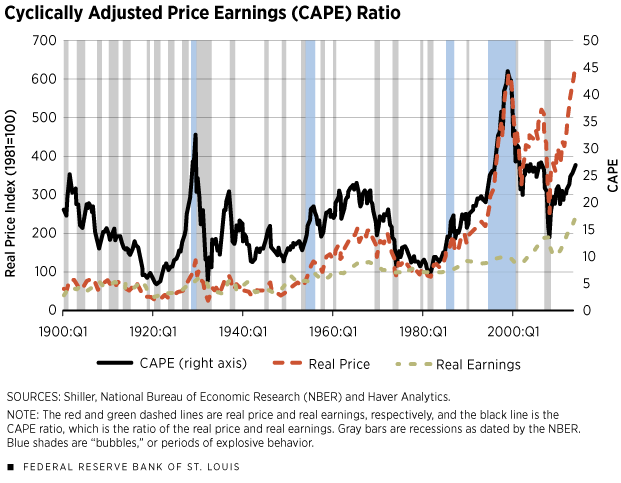

Detecting And Measuring Asset Bubbles Not Easy Tasks St Louis Fed

Price Bubble Definition Historical Examples And Causes

/GettyImages-184064999-5bcf59682a854718a39f9a7430268add.jpg)

How Do Asset Bubbles Cause Recessions

Stock Market Crash Of 1929 Federal Reserve History

Robert Shiller On Stock Market Bubble

We Are Now Officially In A Stock Market Bubble Seeking Alpha

Housing Bubble Getting Ready To Pop Unsold Inventory Of New Houses Spikes By Most Ever To Highest Since 2008 With 9 Months Supply Sales Collapse At Prices Below 400k Wolf Street

Stock Market Crash Definition Effects Top 7 Causes

Stock Market Crash Of 1929 Summary Causes Facts Britannica

Stock Market Bubble Definition Cause And Investing Strategy The Motley Fool

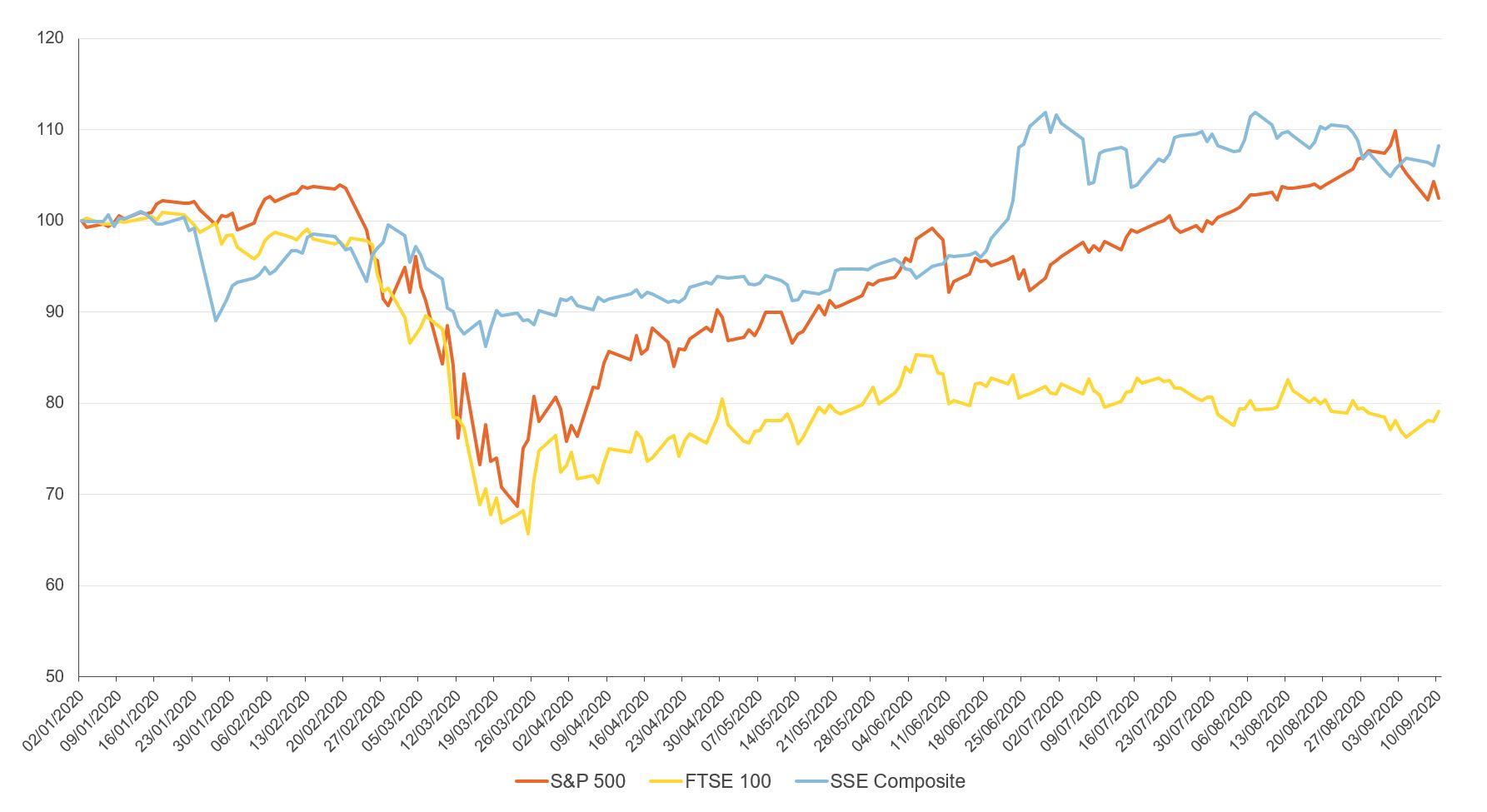

Covid 19 Lockdowns Recession And A New Stock Market Bubble Real Instituto Elcano

Why Has The Stock Market Bounced Back When The Economy Seems So Bad Economics Observatory

Stock Market Rally What Is A Bear Market Rally Vs Bull Market Ig International

The Psychology Of A Stock Market Bubble Marketwatch

The Anatomy Of A Stock Market Crash Financial Strategies Group

What Is A Stock Market Bubble Are We In A Stock Market Bubble Now

/5stagesofabubble-3414b3441b79413cb34c6a49c1167903.jpg)