palm beach county business tax receipt appointment

PO Box 2029. Schedule your driver license appointment up to 60 days in advance.

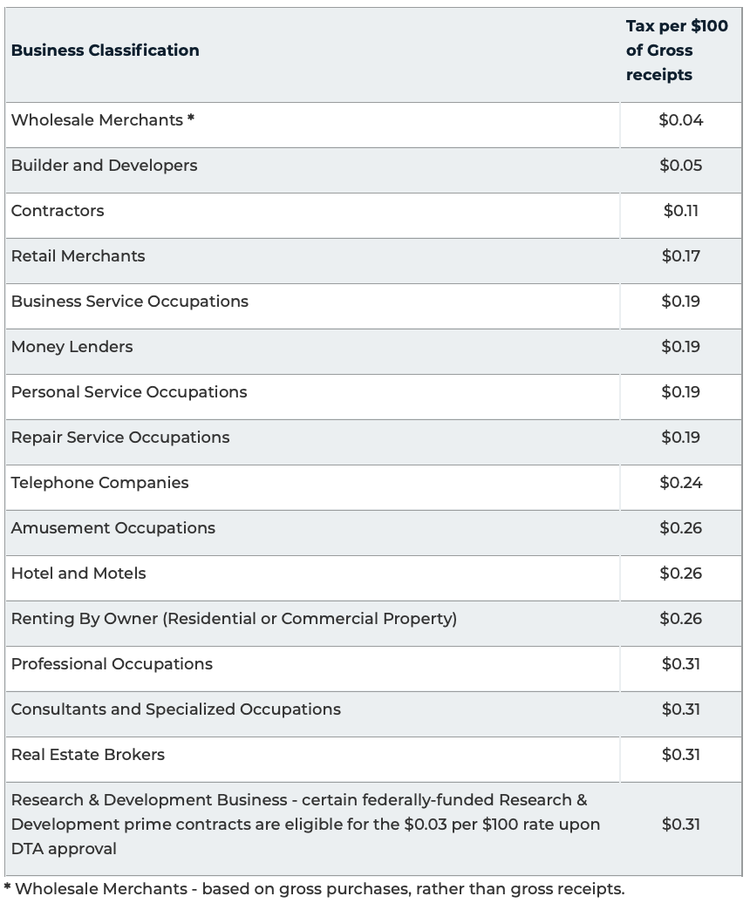

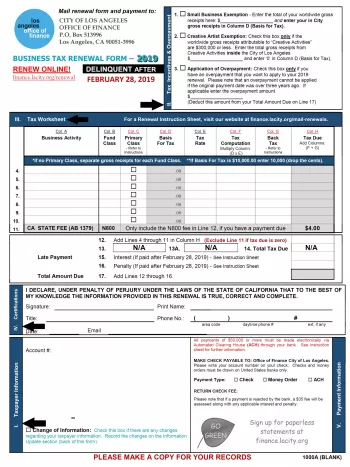

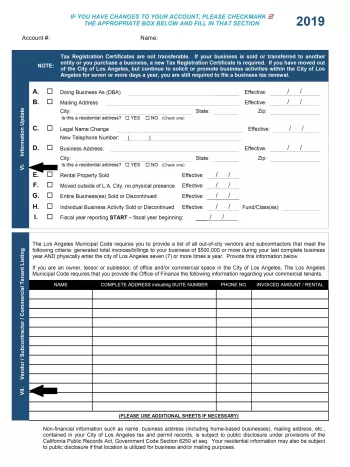

Business Tax Renewal Instructions Los Angeles Office Of Finance

Make sure to select Business Tax as your appointment type.

. West Palm Beach Florida Mon. Constitutional Tax Collector Anne M. Clients moving to Palm Beach County who are establishing residency are considered Palm Beach County residents.

Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us. Constitutional Tax Collector Serving Palm Beach County PO. Box 3353 West Palm Beach FL 33402-3353.

Copy of lease agreement or property owner. Business Tax Department PO. Delinquent Local Business Tax.

Our mission is to deliver the highest quality service and support to the Palm Beach business community with excellence integrity and efficiency. Royal Palm Beach FL 33411. The Zoning Public Information Planner will review the request and verify the zoning district and whether the use is allowed for that specific location.

Town of Palm Beach. 360 South County Road. Tangible personal property tax is applied to businesses that have furniture fixtures andor equipment.

Location Ownership Legal Business Name Dba Name Applicant. For questions about an invoice you received please call 561 355-3643. Completed Palm Beach County Business Tax Receipt Application Do not go to the County Tax Collectors Office until receiving zoning approval from the Village of North Palm Beach and a passing inspection from the Fire Department Copy of Articles of Incorporation andor Fictitious Name Registration.

Business Tax Receipt from the municipality where your office is based. Complete the Application for Local Business Tax Receipt. Palm Beach County Tax Collector Attn.

Palm Beach County Requirements. Dont wait until the last minute. If you are looking for additional information about Drivers License Renewals Auto Tag Renewals andor Registrations Handicap Permits HuntingFishing Licenses or any other County Tax related business OTHER THAN registering for a Business Tax Receipt please call 561 355-2264.

From our schools and libraries to public safety healthcare programs and the environment property taxes support our way of life. Schedule your appointment today. If you need to contact Cheryl McMacken the Business Tax Receipt Coordinator please email her at businessinfogreenacresflgov as she will be unavailable in person in the office from 53122 - 6622.

Completed Palm Beach County Business Tax Receipt Application Do not go to the County Tax Collectors Office until receiving zoning approval from the Village of North Palm Beach and a passing inspection from the Fire Department Copy of Articles of Incorporation andor Fictitious Name Registration. These fees are for the most common type of applications. Your Business Tax Receipt is issued subject to Palm Beach Gardens Code Section 78-159 1.

Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500. APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT __ NEW Business Tax Receipt __ CHANGETRANSFER Circle. Complete the Business Tax Receipt form which can be obtained at the Tax Collectors Office or in the Zoning Division lobby located the second floor at 2300 North Jog Road West Palm Beach FL.

Click Here to Schedule. The Business Tax Receipt Office will be closed on Monday May 30 2022 in observance of Memorial Day. CED Department is responsible for the issuance and collection of all Business Tax Receipts under the authority of Chapter 110 of the City of Palm Bay Code of Ordinance.

Royal Palm Beach Application. Palm Beach FL 33480. A business tax receipt is a tax levied upon all businesses within the municipal boundaries.

I hereby apply for a Home Based Business Tax Receipt to use a business telephone listing business stationery and conduct minor business activity of a business office at my residence. Requirements for making an appointment. I certify that I am eligible to apply for this Business Tax Receipt and.

About Local Business Tax. Business Tax Receipt for Short Term Rentals are only processed at our administrative office on the third floor of the Governmental Center 301 N. West Palm Beach FL.

Closing or Moving a Business. For all questions related to a Palm Beach County CARES Act program payment please see CARES Act Payments. Box 3353 West Palm Beach FL 33402-3353.

Establish a TDT Account. 120 Malabar Road Palm Bay FL 32907. Village Hall 1050 Royal Palm Beach Blvd.

Royal Palm Beach FL 33411 Map. For specific businesses or if you are unsure please call 561-799-4216 for fee estimates. Hours Monday - Friday 800 am - 500 pm.

Cheryl will be answering emails and processing applications. Our office collects and distributes over 4 billion in property taxes annually on behalf of Palm Beach County. Monday - Friday 800 am.

Palm Beach County Office of Equal Business Opportunity OEBO 50 South Military Trail Suite 202 West Palm Beach FL 33415 PH. Payment of the tax receipt does not certify or imply the. General Liability Workers Compensation andor Exemption showing the Village of Royal Palm Beach as the certificate holder.

Business Tax Receipt for Short Term Rentals are only processed at our administrative office on the third floor of the Governmental Center 301 N. Copy of lease agreement or property owner. BTR for Short Term Rentals.

One of our offices most important duties is providing clear concise and transparent information about County revenue and spending. Call our Tourist Development Tax TDT. Search Local Business Tax.

Palm Beach County Office of Equal Business Opportunity OEBO 50 South Military Trail Suite 202 West Palm Beach FL 33415 PH. Make an appointment at one of our service centers to process your completed application. Application for Local Business Tax Receipt.

What the Tax Receipt Is. If your business is based OUTSIDE of Palm Beach County you must provide the following.

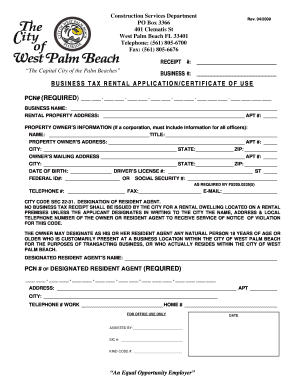

City Of West Palm Beach Business Tax Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable Constitutional Tax Collector Pdf Forms

3 8 2011 4 32 53pm Business Tax Receipt City Of Lakeland

Business Tax Receipts Citrus County Tax Collector

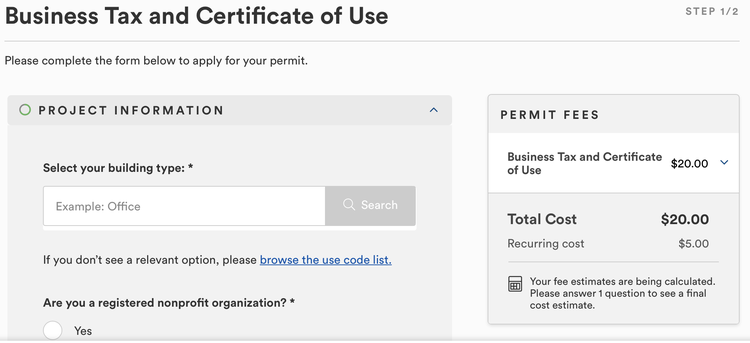

Business Tax And Regulations Btr Division Hallandale Beach Fl Official Website

Fill Free Fillable Constitutional Tax Collector Pdf Forms

County Business Tax Receipt Renewals Start July 1st

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Local Business Tax Constitutional Tax Collector

Business Tax Renewal Instructions Los Angeles Office Of Finance